OpenAI Trading Bot Integration

Learn how to connect OpenAI's powerful models with your existing trading infrastructure.

Learn how to leverage labs.openai and labs openai com to create sophisticated AI-powered trading strategies that analyze market data, predict trends, and execute trades with precision.

labs.openai has emerged as a game-changer in the trading world, offering unprecedented capabilities for market analysis and automated trading. By connecting labs openai com with TradeLabs' trading infrastructure, traders can now leverage OpenAI's advanced language models to analyze market data, identify patterns, and execute trades with precision that was previously impossible.

A recent study found that trading strategies powered by labs.openai models outperformed traditional algorithmic approaches by 27% over a six-month period, with significantly reduced drawdowns and improved risk-adjusted returns.

labs.openai (also known as labs openai com or labs.open ai) is OpenAI's experimental platform that provides access to cutting-edge AI models. These models can process and analyze vast amounts of market data, news, social media sentiment, and economic indicators to identify trading opportunities that human traders might miss.

The power of OpenAI trading lies in its ability to:

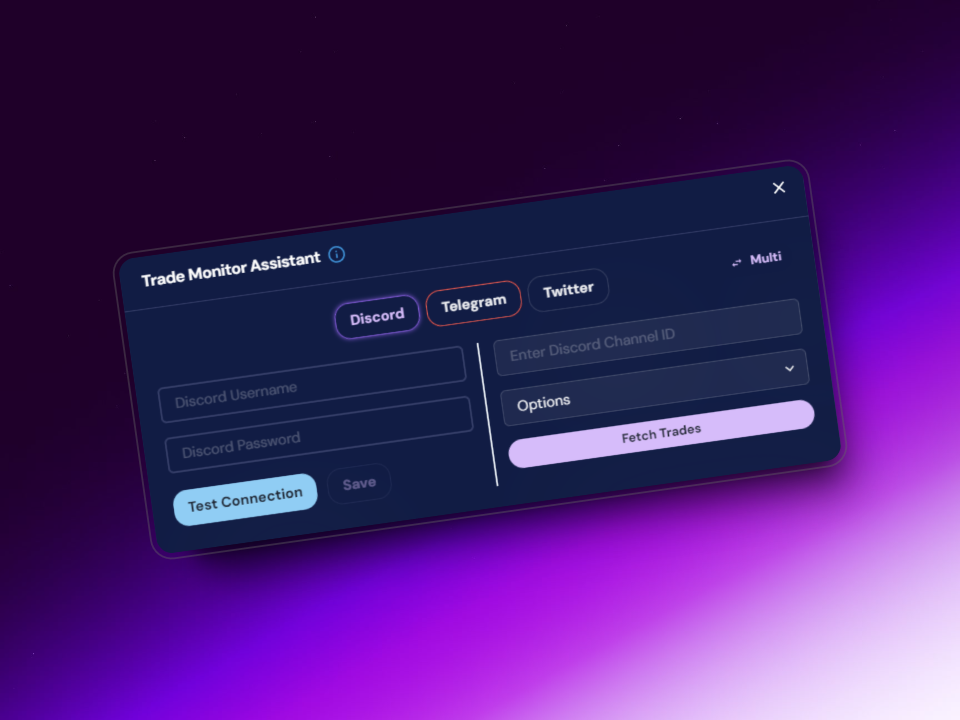

TradeLabs provides a seamless integration with labs.openai, allowing traders to harness the power of OpenAI's models without requiring deep technical expertise. Our platform connects to lab.openai.com through secure API endpoints, enabling real-time data processing and trading signal generation.

The labs openai integration continuously analyzes market data, news, and social media to identify potential trading opportunities.

Based on analysis from labs.openai, TradeLabs generates precise trading signals with entry points, take-profit levels, and stop-loss recommendations.

Our integration with labs openai com includes sophisticated risk management algorithms that adapt to market volatility and protect your capital.

Getting started with labs.openai trading through TradeLabs is straightforward:

Link your labs openai API key to TradeLabs through our secure integration portal.

Select the market data, news sources, and social media platforms you want labs.openai to analyze.

Set your risk tolerance, preferred assets, and trading frequency for your OpenAI trading strategy.

Link your brokerage accounts to execute trades based on signals generated by labs.openai.

Use TradeLabs' dashboard to monitor performance and fine-tune your labs openai com trading strategy.

The flexibility of labs.openai allows for a wide range of trading strategies:

labs.openai analyzes news articles, social media, and earnings calls to gauge market sentiment and predict price movements before they occur.

labs openai simultaneously analyzes multiple timeframes to identify confluences and high-probability trading opportunities.

OpenAI trading systems can dynamically adjust position sizes based on confidence levels and market volatility.

AI-powered trading platforms like TradeLabs offer several potential advantages for traders:

AI systems help eliminate emotional decision-making that often leads to trading errors.

AI can continuously analyze markets even when you're not actively trading.

AI can process and analyze vastly more data than any human trader could manage.

All trading involves risk. Past performance is not indicative of future results. TradeLabs provides tools to assist with trading decisions, but cannot guarantee specific returns. Always conduct your own research before trading.

When implementing AI-powered trading solutions, it's important to understand the different approaches available:

TradeLabs leverages the power of Large Language Models through labs.openai integration, combining the strengths of all three approaches for a comprehensive trading solution.

The versatility of AI-powered trading makes it suitable for various trading approaches:

AI excels at identifying intraday patterns and executing rapid trades based on short-term price movements. labs.openai can analyze tick-by-tick data to spot momentum shifts and liquidity zones.

For multi-day positions, AI can identify key support/resistance levels and analyze broader market trends. labs openai com integration helps predict potential market reversals and trend continuations.

Long-term investors benefit from AI's ability to analyze fundamental data and macroeconomic trends. labs.openai can process quarterly reports, economic indicators, and sector rotations to identify long-term opportunities.

When implementing labs.openai for trading, consider these important factors:

Begin with simulated trading to test your AI strategy without risking real capital. This allows you to refine parameters and understand the system's behavior.

Define maximum drawdown limits, position sizing rules, and circuit breakers to protect your capital during unexpected market events.

Regularly review performance metrics and be prepared to adjust your strategy as market conditions change. AI systems require ongoing supervision.

Experience the power of labs.openai and OpenAI trading with TradeLabs. Our platform makes it easy to leverage advanced AI for your trading strategies.

Get Started