Robinhood automated trading has become increasingly popular among retail investors looking to streamline their trading strategies. With TradeLabs' integration, you can transform your manual Robinhood trading into a fully automated trading Robinhood system that executes trades with precision and reliability.

Studies show that traders using Robinhood automated trading systems can execute up to 100 times more trades per day compared to manual trading, with significantly reduced emotional bias and improved execution accuracy.

Why Choose Robinhood Automated Trading?

Setting up automated trading Robinhood strategies offers several key advantages for retail investors:

- 24/7 Market Monitoring - Your Robinhood automated trading system never sleeps

- Emotional Control - Eliminate emotional trading decisions with automated execution

- Speed and Precision - Execute trades instantly when conditions are met

- Consistent Strategy - Apply your trading rules consistently across all trades

- Multiple Strategy Support - Run multiple automated trading Robinhood strategies simultaneously

- Risk Management - Implement strict stop-loss and position sizing rules automatically

Example of Robinhood Automated Trading Strategy

→ This Robinhood automated trading strategy automatically executes trades based on moving average crossovers

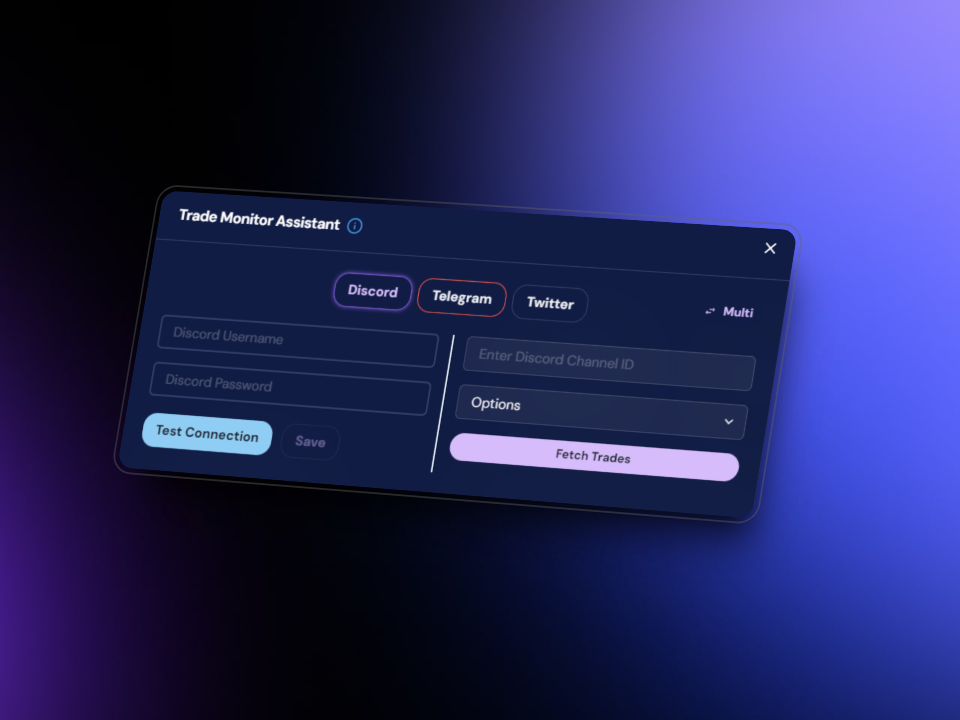

Setting Up Robinhood Automated Trading with TradeLabs

Getting started with automated trading Robinhood through TradeLabs is straightforward:

1️⃣ Connect Your Account

Link your Robinhood account to TradeLabs securely using OAuth authentication for automated trading Robinhood integration.

2️⃣ Define Your Strategy

Create your Robinhood automated trading strategy using our visual strategy builder or code it directly.

3️⃣ Set Risk Parameters

Configure position sizing, stop-losses, and take-profit levels for your automated trading Robinhood system.

4️⃣ Test Your Strategy

Backtest and paper trade your Robinhood automated trading strategy before going live.

5️⃣ Monitor Performance

Track your automated trading Robinhood strategy's performance with detailed analytics and reports.

6️⃣ Optimize & Scale

Fine-tune your Robinhood automated trading strategies based on performance data and market conditions.

Advanced Features for Robinhood Automated Trading

TradeLabs offers sophisticated features for automated trading Robinhood strategies:

📊 Technical Analysis

Integrate advanced technical indicators into your Robinhood automated trading strategies for precise entry and exit points.

🤖 AI-Powered Signals

Leverage machine learning algorithms to enhance your automated trading Robinhood strategy with predictive analytics.

📱 Mobile Monitoring

Track your Robinhood automated trading performance on-the-go with our mobile app.

🔄 Multi-Strategy Support

Run multiple automated trading Robinhood strategies simultaneously with independent risk management.

When setting up your Robinhood automated trading system, start with small position sizes (1-2% of your portfolio per trade) and gradually increase as you gain confidence in your strategy's performance.

Best Practices for Robinhood Automated Trading

Follow these guidelines to maximize your success with automated trading Robinhood strategies:

📈 Start Small

Begin with simple Robinhood automated trading strategies and gradually increase complexity as you gain experience.

🎯 Define Clear Rules

Create precise entry and exit rules for your automated trading Robinhood system to follow.

⚖️ Risk Management

Implement strict position sizing and stop-loss rules in your Robinhood automated trading strategy.

📊 Monitor Performance

Regularly review and optimize your automated trading Robinhood strategies based on performance data.

Start Your Robinhood Automated Trading Journey

Ready to transform your trading with Robinhood automated trading? TradeLabs makes it easy to automate your trading strategies while maintaining full control over your portfolio. Start your free trial today and experience the power of automated trading.

Start Free Trial