Reverse split arbitrage is a trading strategy that exploits a quirk in how some brokers handle fractional shares during reverse stock splits. When a company does a reverse split, shareholders who would receive fractional shares may have those fractions rounded up to a whole share by certain brokers—creating an instant profit opportunity. This guide explains exactly how the strategy works, shows real profit calculations, and covers the serious risks traders face.

Many brokers are closing accounts that repeatedly exploit fractional share rounding. This strategy carries significant risks including account termination, broker fees, and changing policies. This article is educational—not investment advice.

What is a Reverse Stock Split?

To understand this strategy, you first need to grasp the basic concept of a reverse stock split. This is when a company consolidates its outstanding shares, reducing the total count while proportionally increasing the price per share. For example, in a 1-for-10 split, every 10 shares you own become 1 share, and the price multiplies by 10x.

Companies use this tactic to boost their stock price above minimum listing requirements (like NASDAQ's $1 threshold) or to appear more attractive to institutional investors. If a stock trades at $0.50 and undergoes a 1-for-10 consolidation, the new price becomes $5.00—but you only have 1/10th as many shares.

| Before Split | Split Ratio | Math Result | After Split |

|---|---|---|---|

| 100 shares at $0.50 | 1-for-10 | 10 shares | 10 shares at $5.00 |

| 50 shares at $0.40 | 1-for-25 | 2 shares | 2 shares at $10.00 |

| 1 share at $0.80 | 1-for-25 | 0.04 shares | 0.04 shares at $20.00 |

Notice in the last example, owning just 1 share results in 0.04 shares after the split. This is where reverse split arbitrage comes in.

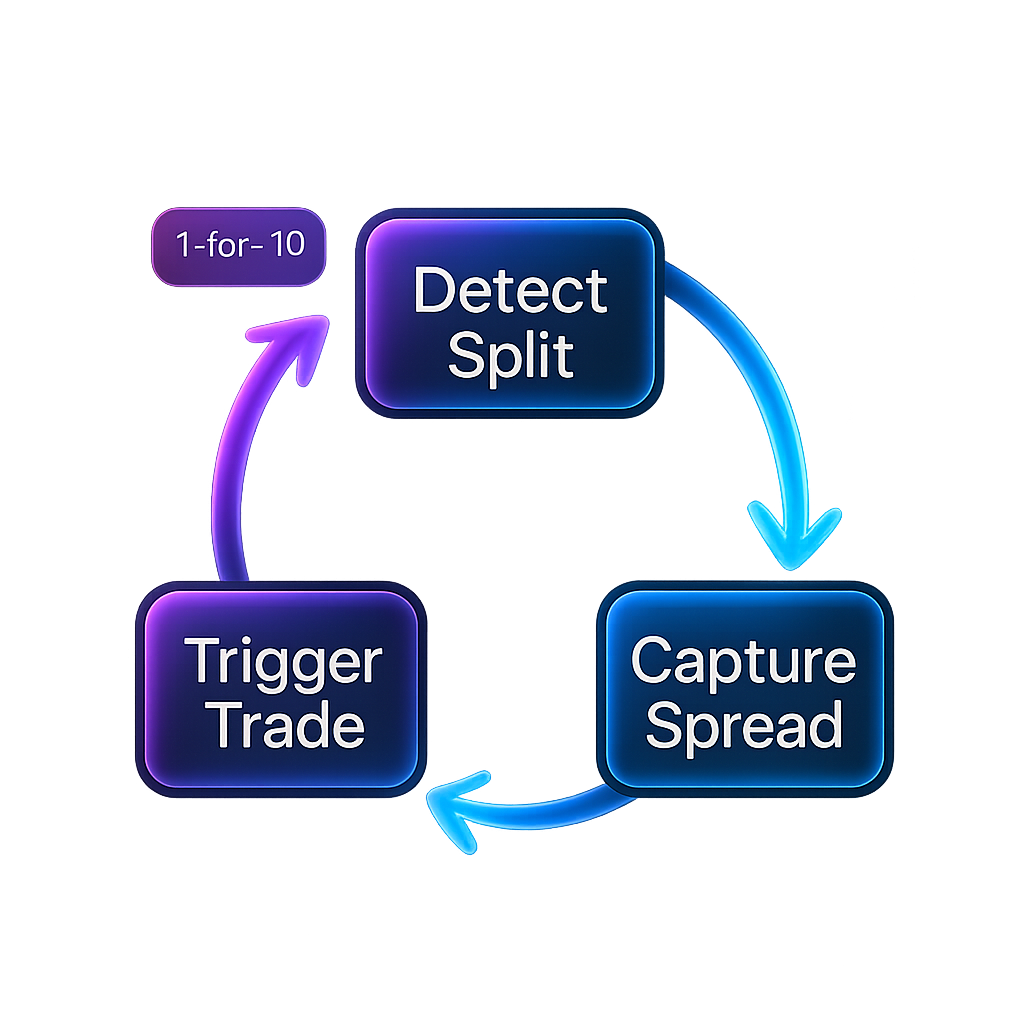

How Reverse Split Arbitrage Works

Here's the key mechanism: when a consolidation creates fractional shares (like 0.04 shares), brokers must decide how to handle them. Some have policies that round up fractions to 1 whole share—and that's where the profit opportunity exists.

Let's walk through a concrete example:

Step 1: Buy the Stock

You buy 1 share of a penny stock trading at $0.80. The company announces a 1-for-25 reverse split. Cost: $0.80

Step 2: The Split Happens

After the split, your 1 share becomes 1÷25 = 0.04 shares. The new stock price is $0.80 × 25 = $20.00. You own 0.04 shares worth $0.80.

Step 3: Broker Rounds Up

Your broker rounds 0.04 shares up to 1 whole share worth $20.00. You sell for $20.00. Profit: $20.00 - $0.80 = $19.20 (2,400% return!)

That's the basic concept. Sounds simple and profitable, right? But there are major limitations and risks you need to understand.

Which Brokers Round Up Fractional Shares?

This is the critical question—and the answer keeps changing. Not all brokers round up, and many that previously did have stopped due to traders exploiting this loophole.

| Broker | Rounds Up? | Fees | Notes |

|---|---|---|---|

| TD Ameritrade | Avoid | $38 | Charges $38 for reverse split processing |

| Alpaca | No | $0.75 | Deposits fractional shares instead of rounding |

| Robinhood | Sometimes | $0 | Intermittently deposits fractional shares |

| Fidelity | Variable | $0 | No fees but policies vary by situation |

Policies change constantly. What worked 6 months ago may not work today. Many firms have caught on and now deposit fractions instead of rounding.

Real-World Profit Calculations

Here are actual examples from recent reverse splits to illustrate the theoretical profit potential:

- SEEL (1:16 split) - Buy at $0.29, split creates $4.64 shares. If rounded up from 0.0625 shares to 1 share, profit = $4.35 per share (1,500% return)

- ARQQ (1:25 split) - Buy at $0.29, split creates $7.25 shares. If rounded up from 0.04 shares to 1 share, profit = $6.96 per share (2,400% return)

- FRGT (1:25 split) - Buy at $0.11, split creates $2.75 shares. If rounded up from 0.04 shares to 1 share, profit = $2.64 per share (2,400% return)

These numbers look incredible, but remember: these only work if your broker rounds up, if the company doesn't cancel the split, if you can sell quickly enough, and if your account doesn't get flagged or closed.

Important Considerations and Limitations

While reverse split arbitrage is a legitimate strategy, there are important factors to understand before attempting it:

- Broker-Specific Policies - Each broker handles fractional shares differently. Some round up, others deposit fractions, and policies change over time.

- One Trade Per Account - The strategy only works once per account per split, so traders often use multiple brokers to maximize opportunities.

- Account Terms of Service - Some brokers (like Ally Financial) have closed accounts for repeated RSA trading. Most brokers allow it but a few explicitly restrict it.

- Split Cancellations - Companies can delay or cancel reverse splits, leaving you holding penny stocks.

- Liquidity Challenges - Many reverse split stocks have low trading volume, which can make it difficult to enter or exit positions at desired prices.

- Broker Fees - Some brokers charge processing fees (like ETrade's $38 fee) that can eliminate profits on small positions.

How TradeLabs Automates RSA Signal Detection

Manually tracking reverse splits across hundreds of stocks is time-consuming. TradeLabs automates the entire process, providing:

- Real-Time Split Monitoring - Automatically scan SEC filings and company announcements for upcoming reverse splits

- Profit Calculators - Instantly calculate potential returns based on split ratios, current prices, and broker policies

- Broker Compatibility Tracking - Know which brokers currently round up fractional shares and which ones to avoid

- Automated Alerts - Get notified immediately when new RSA opportunities are detected

- Historical Data - Review past reverse splits and their outcomes to identify patterns

Our live RSA signals database tracks current opportunities, effective dates, split ratios, and estimated profit potential for each signal.

Start Tracking RSA Signals

Get instant access to automated reverse split monitoring, profit calculations, and real-time alerts when new opportunities are detected.

Get Access →Tips for Successful RSA Trading

If you decide to trade reverse split arbitrage, here are key strategies to maximize success:

- Use multiple broker accounts - Since each account only works once per split, traders typically maintain 5-10+ accounts at different brokers

- Verify broker policies first - Always confirm a broker rounds up before opening an account specifically for RSA

- Buy close to the effective date - Minimize the time holding volatile penny stocks by purchasing 1-3 days before the split

- Start small - Test with 1-2 shares to verify your broker rounds up before scaling

- Factor in fees - Calculate whether commission costs or processing fees will eat into profits

- Track your trades - Keep detailed records of which brokers work and which splits were profitable

The Bottom Line on Reverse Split Arbitrage

Reverse split arbitrage is a legitimate, legal trading strategy that can generate high-percentage returns with relatively low capital requirements. The key challenges are finding brokers that round up fractional shares and managing the one-trade-per-account limitation.

It's not a "get rich quick" scheme—profits are typically $5-$20 per trade, and you need multiple broker accounts to scale. However, for traders willing to put in the work to track splits and manage multiple accounts, it can be a consistent supplementary income source.

The landscape is evolving as some brokers move toward depositing fractional shares, but plenty of brokers still round up. Success comes from staying informed about broker policy changes and acting quickly when opportunities arise.